UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material |

SELLAS LIFE SCIENCES GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

August 7, 2019April 23, 2021

Dear FellowTo Our Stockholders:

You are cordially invited to attend the 2021 annual meeting of stockholders of SELLAS Life Sciences Group, Inc. (the “Company”) to be held at 8:30 a.m. Eastern Time on June 8, 2021 (the “2021 Annual Meeting”) via live webcast. In light of public health restrictions and recommendations relating to the ongoing coronavirus (COVID-19) pandemic, we will hold the 2021 Annual Meeting virtually via live webcast. You will be able to attend and participate in the 2021 Annual Meeting online via the live webcast and vote your shares electronically by visiting: www.meetingcenter.io/287191590. The password for the meeting is: SLS2021. There is no physical location for the 2021 Annual Meeting.

The enclosed Notice of Annual Meeting of Stockholders sets forth the proposals that will be presented at the 2021 Annual Meeting, which are described in more detail in the enclosed Proxy Statement. Our Board of Directors recommends that you vote “FOR” Proposals 1, 2, 3 and 4 as set forth in the Proxy Statement.

Under Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders over the Internet, we have elected to deliver our proxy materials to our stockholders over the Internet, unless a stockholder requests printed materials. This delivery process allows us to provide stockholders with the information they need, while at the same time conserving natural resources and lowering the cost of delivery. On or about April 26, 2021, we intend to begin sending to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our Proxy Statement for the 2021 Annual Meeting and our 2020 annual report to stockholders. The Notice also provides instructions on how to vote online and how to receive a paper copy of the proxy materials by mail.

We hope you will be able to attend the 2021 Annual Meeting. Whether you plan to attend the 2021 Annual Meeting or not, it is important that you cast your vote. You may vote over the Internet as well as by telephone or by mail. When you have finished reading the Proxy Statement, you are urged to vote in accordance with the instructions set forth in the Proxy Statement. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting, whether or not you can attend.

On behalf of the Board and the management team, we thank you for your ongoing support of, Directors (the "Board") ofand continued interest in, SELLAS Life Sciences Group, Inc. (the "Company"), you are cordially invited to attend a Special Meeting of Stockholders to be held at 8:30 a.m., local time, on September 10, 2019, at 15 West 38th Street, 4th Fl., New York, New York 10018.

At the Special Meeting, stockholders will consider and vote on

The proxy statement attached to this letter provides you with information regarding the above three proposals. Please read the entire proxy statement carefully. You may obtain additional information about the Company from documents we file with the Securities and Exchange Commission.

It is important that your shares be represented and voted at the meeting. Please vote as soon as possible even if you plan to attend the Special Meeting. We appreciate your continued ownership of the Company shares and your support regarding this matter.

| Very truly yours, | |

| |

| Angelos M. Stergiou, M.D., Sc.D. h.c. | |

| President and Chief Executive Officer |

SELLAS LIFE SCIENCES GROUP, INC.

15 West 38th Street, 10th FloorTimes Square Tower, 7 Times Square, Suite 2503

New York, New York 1001810036

NOTICE OF SPECIAL2021 ANNUAL MEETING OF STOCKHOLDERSTo Be Held on September 10, 2019

| DATE: | June 8, 2021 |

| PLACE: | Via live webcast. Go to: www.meetingcenter.io/287191590; the password is: SLS2021. There is no physical location for the 2021 Annual Meeting. |

PURPOSES:

| 1. | To |

| 2. | To |

| 3. | To approve, |

| 4. | To approve the 2021 Employee Stock Purchase Plan; and |

| 5. | To transact such other business as may properly come before the 2021 Annual Meeting and any adjournment |

WHO MAY VOTE:

The close of business on July 12, 2019 has been fixed asYou may vote if you were the record date for determining those stockholders entitled to vote atowner of the Special Meeting. Accordingly, only stockholders of recordCompany’s common stock at the close of business on that dateTuesday, April 13, 2021. A list of stockholders of record will receive this notice of, and be eligible to voteavailable at the Special2021 Annual Meeting and, any adjournment or postponement ofduring the Special Meeting. The above items of business for10 days prior to the Special2021 Annual Meeting, are more fully described in the proxy statement that accompanies this notice.at our principal executive offices located at Times Square Tower, 7 Times Square, Suite 2503, New York, NY 10036.

Your vote is important. Please readAll stockholders are cordially invited to attend the proxy statement and the instructions on the enclosed proxy card and then, whether or not2021 Annual Meeting. Whether you plan to attend the Special2021 Annual Meeting or not, we urge you to vote promptly in person, and no matter how many shares you own, please submit your proxy promptly by telephone or viaorder to ensure the Internet in accordance with the instructions on the enclosed proxy card, or by completing, dating and returning your proxy card in the envelope provided. This will not prevent you from voting in person at the Special Meeting. It will, however, help to assurepresence of a quorum and to avoid added proxy solicitation costs.

quorum. You may change or revoke your proxy at any time before the voteit is taken by delivering to the Secretary of the Company a written revocation or a proxy with a later date (including a proxy by telephone or via the Internet) or by voting your shares in personvoted at the Special Meeting, in which case your prior proxy would be disregarded.meeting.

| By | |

| |

| Barbara A. Wood | |

| Executive Vice President, General Counsel and Corporate Secretary | |

New York, New York

April 23, 2021

TABLE OF CONTENTS

(i)i

SELLAS LIFE SCIENCES GROUP, INC.

15 West 38th Street, 10th FloorTimes Square Tower, 7 Times Square, Suite 2503

New York, New York 1001810036

PROXY STATEMENT

FOR THE SPECIAL2021 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON

Friday, September 10, 2019Tuesday, June 8, 2021

This Proxy Statement, along with the accompanying notice of 2021 Annual Meeting, contains information about the annual meeting of stockholders of SELLAS Life Sciences Group, Inc., including any adjournments or postponements of the 2021 Annual Meeting. We are holding the 2021 Annual Meeting at 8:30 a.m., Eastern Time, on June 8, 2021 via live webcast. There will be no physical location for the 2021 Annual Meeting. We refer, in this Proxy Statement, to SELLAS Life Sciences Group, Inc. as “SELLAS,” “the Company,” “we” and “us,” or “our.”

This Proxy Statement relates to the solicitation of proxies by our Board of Directors for use at the 2021 Annual Meeting.

On or about April 26, 2021, we intend to begin sending to our stockholders the Important Notice Regarding the Availability of Proxy Materials for the Special Meetingcontaining instructions on how to be Held on September 10, 2019:

Theaccess our proxy statement is available atwww.envisionreports.com/SLS

This proxy statement is being furnished to you by the Board of Directors (the "Board" or "Board of Directors") of SELLAS Life Sciences Group, Inc. (the "Company") to solicit your proxy to vote your shares atfor our Special2021 Annual Meeting of Stockholders (the "Special Meeting"). The Special Meeting will be held on September 10, 2019 at 8:30 a.m., local time, at 15 West 38th Street, 4th Floor, New York, New York 10018.

This proxy statement, the foregoing notice and the accompanying proxy card are first being made available on or about August [5], 2019 to all holders of our common stock entitled to vote at the Special Meeting.

Purpose of the Special Meeting

The purpose of the Special Meeting is to consider and vote on the following proposals:

If the Reverse Stock Split proposal is approved by the Company's stockholders at the Special Meeting, it will be effected, if at all, only upon a subsequent determination by the Board, not later than the date that is within one year from the date of the Special Meeting, that the Reverse Stock Split is in the best interests of the Company and our stockholders. The Board may make this determination as soon as immediately following the conclusion of the Special Meeting, and the Reverse Stock Split could become effective as soon as the business day immediately following the Special Meeting.

Notwithstanding approval of the Reverse Stock Split proposal by our stockholders, the Board reserves its right2020 annual report to elect not to proceed with implementing the Reverse Stock Split proposal at any time prior to the date on which the amendment to our Amended and Restated Certificate of Incorporation becomes effective under Delaware law, if it determines, in its sole discretion, that the Reverse Stock Split is no longer in the best interests of the Company or its stockholders.

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING THESE PROXY MATERIALS AND VOTING

WhoWhy is entitledthe Company Soliciting My Proxy?

Our Board of Directors is soliciting your proxy to vote at the Special Meeting?2021 Annual Meeting to be held via live webcast, on June 8, 2021, at 8:30 a.m., Eastern Time, and any adjournments or postponements of the meeting, which we refer to as the 2021 Annual Meeting. This proxy statement, along with the accompanying Notice of Annual Meeting of Stockholders, summarizes the purposes of the meeting and the information you need to know to vote at the 2021 Annual Meeting.

HoldersWe have made available to you on the Internet or have sent you this proxy statement, the Notice of Annual Meeting of Stockholders, the proxy card and a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, because you owned shares of our common stock on April 13, 2021, or the Record Date. We intend to commence distribution of the Company’s common stockImportant Notice Regarding the Availability of Proxy Materials, which we refer to throughout this proxy statement as the Notice, and, if applicable, proxy materials, to stockholders on or about April 26, 2021.

Why Did I Receive a Notice in the Mail Regarding the Internet Availability of Proxy Materials Instead of a Full Set of Proxy Materials?

As permitted by the rules of the U.S. Securities and Exchange Commission, or the SEC, we may furnish our proxy materials to our stockholders by providing access to such documents on the Internet, rather than mailing printed copies of these materials to each stockholder. Stockholders will not receive printed copies of the proxy materials unless they request them. We believe that this process will expedite stockholders’ receipt of proxy materials, lower the costs of the 2021 Annual Meeting and help to conserve natural resources. If you received the Notice by mail or electronically, you will not receive a printed or email copy of the proxy materials, unless you request one by following the instructions included in the Notice. Instead, the Notice instructs you as to how you may access and review all of the proxy materials and submit your proxy on the Internet. If you requested a paper copy of the proxy materials, you may authorize the voting of your shares by following the instructions on the proxy card, in addition to the other methods of voting described in this proxy statement.

How do I attend the 2021 Annual Meeting?

The 2021 Annual Meeting will be held on Tuesday, June 8, 2021, at 8:30 a.m., Eastern Time, via live webcast. You will be able to attend and participate in the 2021 Annual Meeting online via live webcast and vote your shares electronically by visiting: www.meetingcenter.io/287191590 on the meeting date and time described in this Proxy Statement. The password for the meeting is: SLS2021. There is no physical location for the 2021 Annual Meeting. You are entitled to participate in the 2021 Annual Meeting only if you were a stockholder of the Company as of the close of business on the record date, July 12, 2019,Record Date or if you hold a valid proxy for the 2021 Annual Meeting.

How do I submit questions?

You may submit questions in advance of the 2021 Annual Meeting by emailing the questions, along with proof of ownership, to questions2021@sellaslife.com prior to 8:30 a.m. Eastern Time on June 7, 2021. You may also submit questions during the 2021 Annual Meeting by visiting: www.meetingcenter.io/287191590. We will, receive noticesubject to time constraints, answer all questions that are pertinent to the business of the 2021 Annual Meeting and be eligiblewill give priority to questions submitted in advance.

Who can vote at the Special Meeting and any adjournment or postponement2021 Annual Meeting?

Only stockholders of the Special Meeting. Atrecord at the close of business on the record date, the Company had outstanding andRecord Date will be entitled to vote 210,092,687 shares of common stock. No other shares of the Company’s capital stock are entitled to notice of and to vote at the Special2021 Annual Meeting. On the Record Date, there were 15,084,754 shares of common stock issued and outstanding. Our common stock is our only class of voting stock.

How Do I Vote?

How do I attend the Special Meeting?

All stockholders of record on July 12, 2019 are invited to attend the Special Meeting. You must bring proof of your identity to attend the special meeting. If you are the beneficial owner of shares held in the name of your broker, bank or other nominee, you must bring both proof of ownership of shares as of the record date (e.g., a broker's statement) and a photo ID in order to be admitted to the meeting. IfWhether you plan to attend the meeting,2021 Annual Meeting or not, we will have representatives onsiteurge you to assist with registration for the event.

What mattersvote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via the Internet or telephone. You may specify (i) whether your shares should be voted FOR or WITHHELD for Proposal 1, our nominee for Class II director, and (ii) whether your shares should be voted for, against or abstain with respect to Proposals 2, 3 and 4. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with our Board of Directors’ recommendations as noted below. Voting by proxy will not affect your right to attend the 2021 Annual Meeting. You may vote by one of the following methods:

| By Internet: If you have Internet access, you may submit your vote from any location in the world by following the instructions in the Notice or following the instructions on the proxy card or voting instruction card sent to you. |

| By Telephone: You may submit your vote by following the telephone voting instructions on the proxy card or voting instruction card sent to you. |

| By Proxy by Mail: You may vote by mail by requesting a full paper copy of the Proxy Statement materials as instructed in the Notice of Internet Availability and marking, dating and signing your proxy card or, for shares held in street name, the voting instruction card provided to you by your broker or nominee, and mailing it in the enclosed, self-addressed, postage prepaid envelope. |

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at the Special Meeting?1:00 a.m. Eastern Time on June 8, 2021.

The three proposals that are scheduled to be considered and voted on at the Special Meeting are the Reverse Stock Split proposal, the 2019 Equity Plan proposal and the adjournment proposal.

What are the Board's voting recommendations?

The Board recommends that you vote "FOR" the Reverse Stock Split proposal, “FOR” the 2019 Equity Plan proposal and "FOR" the adjournment proposal.

Why does the Company need stockholders to vote on the Reverse Stock Split?

On May 31, 2019, we received a written notification from The Nasdaq Stock Market LLC (“Nasdaq”) indicating that the Company was not in compliance with Nasdaq Listing Rule 5550(a)(2) because the minimum bid price of the Company’s shares of common stock was below $1.00 per share for the previous 30 consecutive business days. We have been provided an initial period of 180 calendar days, or until November 27, 2019, to regain compliance with the minimum bid price rule. To regain compliance, the closing bid price of the Company’s shares of common stock must meet or exceed $1.00 per share for at least ten consecutive business days during this 180-day grace period. If we do not regain compliance with the minimum bid price rule by November 27, 2019, we may be eligible for an additional compliance period of 180 calendar days; however, such extension is at the discretion of Nasdaq and there can be no assurance that Nasdaq will grant the extension. If we do not regain compliance with the minimum bid price rule by November 27, 2019 and are not granted an additional compliance period at that time, Nasdaq will provide written notification to us that our common stock may be delisted. At that time, we may appeal Nasdaq’s delisting determination to a Nasdaq hearings panel. If we timely appeal, our common stock would remain listed pending the panel’s decision. There can be no assurance that, if we do appeal the delisting determination by Nasdaq to the panel, such appeal would be successful.

The Board has determined that an amendment to our Amended and Restated Certificate of Incorporation to effect the Reverse Stock Split is necessary to the continued listing of our common stock on Nasdaq and is in the best interests of our stockholders. If approved and implemented, the Board will select a Reverse Stock Split ratio of not less than 1-for-20 and not greater than 1-for-60, with the exact ratio and effective time of the Reverse Stock Split to be determined by the Board at any time within one year of the date of the Special Meeting based on various factors, including the then prevailing market conditions and the existing and expected per share trading prices of our common stock. Pursuant to the law of our state of incorporation, Delaware, the Board must adopt any amendment to our Amended and Restated Certificate of Incorporation and submit the amendment to stockholders for approval. Accordingly, the Board is requesting your proxy to vote "FOR" the Reverse Stock Split proposal and "FOR" the adjournment proposal.

In addition to bringing the per share trading price of our common stock back above $1.00, we also believe that the Reverse Stock Split will make our common stock more attractive to a broader range of institutional and other investors, as we have been advised that the current per share trading price of our common stock may affect its acceptability to certain institutional investors, professional investors and other members of the investing public. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. In addition, some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If on the Record Date your shares were registered directly in your name with our transfer agent, Computershare, Inc.,then you are considered the "stockholdera stockholder of record" with respect to those shares.

record. If on the Record Date your shares were not held instead in your name, but rather in an account at a stock brokerage account or by afirm, bank, dealer or other nominee, those shares are held in "street name" andsimilar organization, then you are considered the "beneficial owner" of the shares. As the beneficial owner of those shares you haveheld in “street name.” You must follow the right to direct your broker, bank or nominee how to vote your shares, and you will receive separate instructions from your broker, bank or otherof the holder of record describing howin order for your shares to vote your shares.be voted.

How can I vote my shares before the Special Meeting?Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may submit avote during the 2021 Annual Meeting, vote by proxy byover the telephone viaor through the Internet, or vote by mail.

·Submitting a Proxy by Telephone: You can submitproxy using a proxy for your shares by telephone until 11:59 p.m. Eastern Daylight Time on September 9, 2019, by callingcard. Whether or not you plan to attend the toll-free telephone number on the enclosed proxy card, 1-800- 652-VOTE (8683). Telephone proxy submission is available 24 hours a day. Easy-to-follow voice prompts allow2021 Annual Meeting, we urge you to submit avote by proxy forto ensure your shares and confirm that your instructionsvote is counted. You may still attend the 2021 Annual Meeting even if you have been properly recorded. Our telephone proxy submission procedures are designed to authenticate stockholdersalready voted by using individual control numbers.

·Submitting a Proxy via the Internet: You can submit a proxy for your shares via the Internet until 11:59 p.m. Eastern Daylight Time on September 9, 2019, by accessing the website listed on the enclosed proxy card, www.envisionreports.com/SLS, and following the instructions you will find on the website. Internet proxy submission is available 24 hours a day. As with telephone proxy submission, you will be given the opportunity to confirm that your instructions have been properly recorded.

·Submitting a Proxy by Mail:proxy. If you choose to submit avoted by proxy for your shares by mail, simply mark the enclosed proxy card, date and sign it, and return it in the postage paid envelope provided.

By casting your vote in any of the three ways listed above, you are authorizing the individuals listed on the proxydecide to vote, or change your sharesproxy, while in attendance at the 2021 Annual Meeting, you must first revoke your proxy at the 2021 Annual Meeting and then vote in accordance with your instructions. You may also attend the Special Meeting andinstructions provided at the 2021 Annual Meeting.

| · | To vote during the 2021 Annual Meeting, you must follow the instructions provided for voting during the live webcast. |

| · | To vote using the proxy card, simply complete, sign and date the proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the 2021 Annual Meeting, we will vote your shares as you direct. |

| · | To vote over the telephone, dial toll-free 1-800-652-VOTE (8683) using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the enclosed proxy card. Your telephone vote must be received by 1:00 a.m., Eastern Time on June 8, 2021 to be counted. |

| · | To vote through the Internet, go to www.envisionreports.com/SLS to complete an electronic proxy card. You will be asked to provide the control number from the enclosed proxy card. Your Internet vote must be received by 1:00 a.m. Eastern Time on June 8, 2021 to be counted. |

Beneficial Owner: Shares Registered in person.the Name of Broker, Bank or Other Nominee

If you are thea beneficial owner of shares registered in the name of your broker, bank, or other nominee, you should followhave received a voting instruction form with these proxy materials from that organization rather than from us. Simply complete and mail the instructionsvoting instruction form to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker, bank or other nominee.

What am I voting on?

This Proxy Statement describes the proposals on which we would like you, as a stockholder, to vote at the 2021 Annual Meeting. This Proxy Statement provides you with information on the proposals, as well as other information about us, so that you can make an informed decision as to whether and how to vote your stock.

At the 2021 Annual Meeting, stockholders will act upon the following three proposals:

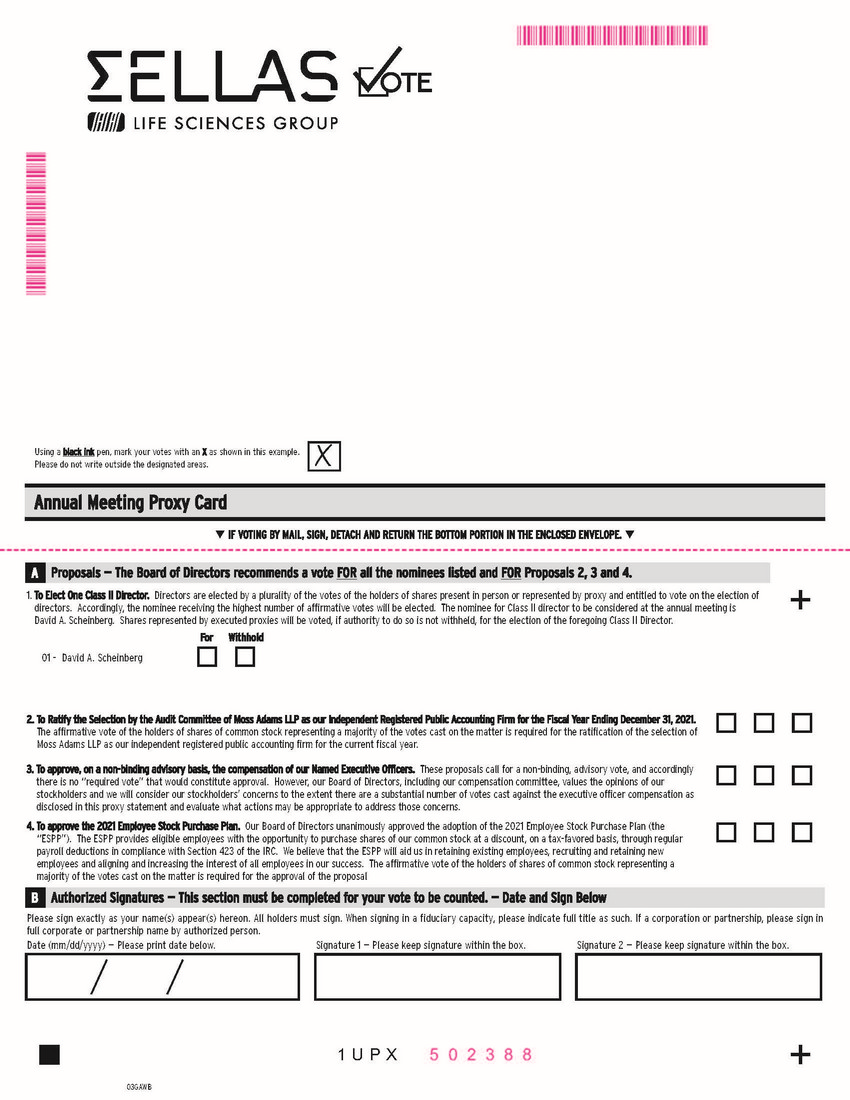

| Proposal 1: | To elect one Class II director to serve on our Board for a three-year term expiring on the date on which our annual meeting is held in 2024. |

| Proposal 2: | To ratify the appointment by our Audit Committee of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021. |

| Proposal 3: | To approve, on a non-binding advisory basis, the compensation of our named executive officers, as disclosed in this Proxy Statement. |

| Proposal 4: | To approve the 2021 Employee Stock Purchase Plan. |

How Does our Board of Directors Recommend That I Vote on the Proposals?

Our Board of Directors recommends that you vote as follows:

| § | “FOR” the election of the nominee for Class II director; |

| § | “FOR” the ratification of the appointment of Moss Adams LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2021; |

| § | “FOR” the compensation of our named executive officers, as disclosed in this proxy statement; and |

| § | “FOR” the 2021 Employee Stock Purchase Plan. |

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of the Record Date.

What happens if I do not vote?

Stockholder of Record: Shares Registered in the materialsYour Name

If you received with this proxy statement from the holderare a stockholder of record forand do not vote, your shares towill not be voted.

The availabilityBeneficial Owner: Shares Registered in the Name of telephonicBroker or Internet voting will depend on the bank's or broker's voting process. Please check with your bank or broker and follow the voting procedures your bank or broker provides to vote your shares. Also, please note that if the holder of record of your shares is a bank, broker or other nominee and you wish to vote in person at the Special Meeting, you must request a legal proxy from your bank, broker or other nominee that holds your shares and present that proxy and a photo ID at the Special Meeting; otherwise, you will not be able to vote in person at the Special Meeting.

If I am the beneficial owner of shares held in "street name" by my broker, will my broker automatically vote my shares for me?Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other nominee (sometimes referred to as shares held in “street name”) and you do not provide instructions how to vote your shares, your broker, bank or other nominee may still be able to vote your shares in its discretion. A broker or other nominee may generally vote in their discretion on “routine”routine matters. In this regard, Proposals 1, 3 and 34 are considered to be “routine”“non-routine”, meaning that if your broker does not receive instructions from you on how to vote your shares on such routinenon-routine matter, the broker will have discretion to vote your shares. Proposal 2 is considered to be a “non-routine” matter meaning that if you do not return voting instructions to your broker by its deadline, the broker will not have the authority to vote on the matter with respect to your shares. This is generally referred to as a “broker non-vote.” Therefore, broker non-votes may exist in connection with Proposals 1, 3 and 4. However, Proposal 2 is considered to be a “routine” matter, meaning that if you do not return voting instructions to your broker by its deadline, your shares may be voted by your broker in its discretion on Proposal 2.

How will my shares be votedWhat if I give myreturn a proxy card or otherwise vote but do not specify how my shares should be voted?make specific choices?

If you provide specificreturn a signed and dated proxy card or otherwise vote without marking voting instructions,selections, your shares will be voted, as applicable:

| · | “FOR” the election of one Class II director to serve on our Board for a three-year term expiring on the date on which our annual meeting is held in 2024. |

| · | “FOR” the ratification of the appointment by our Audit Committee of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021. |

| · | “FOR” the advisory approval of named executive compensation. |

| · | “FOR” the 2021 Employee Stock Purchase Plan. |

If any other matter is properly presented at the Special2021 Annual Meeting, in accordance with your instructions. If you are a stockholder of record and sign and return a proxy card without giving specific voting instructions,proxyholder will vote your shares will be voted "FOR" the Reverse Stock Split proposal, "FOR" the 2019 Equity Plan proposal and "FOR" the adjournment proposal.using their best judgment.

What voteWho is the required to pass each proposal?paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other nominees for the cost of forwarding proxy materials to beneficial owners. We have engaged The affirmative voteProxy Advisory Group, LLC to assist in the solicitation of the holders ofproxies and provide related advice and information support, for a majority of the outstanding shares of our common stock as of the record date is required to approve the Reverse Stock Split proposalservices fee and the affirmativereimbursement of customary disbursements, which are not expected to exceed $15,000 in total.

Can I change my vote after submitting my proxy?

Stockholder of a majority ofRecord: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the votes cast by stockholders present, in person or by proxy, and entitled tofinal vote at the Special Meeting, is required to approve the 2019 Equity Plan proposal and the adjournment proposal.

Can I vote in person at the Special Meeting?

Yes. If you hold shares in your own name as a stockholder of record, you may come to the Special Meeting and cast your vote at the meeting by properly completing and submitting a ballot.2021 Annual Meeting. If you are the beneficial ownerrecord holder of your shares, heldyou may revoke your proxy in any one of the following ways:

| · | You may submit another properly completed proxy card with a later date. |

| · | You may grant a subsequent proxy by telephone or through the Internet. |

| · | You may send a timely written notice that you are revoking your proxy to our Corporate Secretary at SELLAS Life Sciences Group, Inc., Times Square Tower, 7 Times Square, Suite 2503, New York, New York 10036. |

| · | You may cast a vote at the meeting. |

Your most current proxy card or telephone or Internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the nameName of Broker or Bank

If your shares are held by your broker, bank or other nominee, you must first obtain a legal proxy fromshould follow the instructions provided by your broker, bank or other nominee giving you the right to vote those shares and submit that proxy along with a properly completed ballot at the meeting; otherwise, you will not be able to vote in person at the Special Meeting.

How can I change my vote?nominee.

You may revoke your proxy at any time before it is exercised by:

Any written notice of revocation, or later dated proxy, should be delivered to:When are stockholder proposals and director nominations due for next year’s annual meeting?

SELLAS Life Sciences Group, Inc.

15 West 38th Street, 10th Floor

Proposals of stockholders intended to be presented at our 2022 annual meeting of stockholders pursuant to Rule 14a-8 promulgated under the Exchange Act must be received by us at our principal offices, Times Square Tower, 7 Times Square, Suite 2503, New York, New York 10018

10036, Attention: Barbara A. Wood, Corporate Secretary,

Alternatively, you may hand deliver a written revocation notice, or a no later dated proxy,than December 24, 2021, the date that is 120 days prior to the Secretary atfirst anniversary of the Special Meeting before we begin voting.date of this proxy statement, in order to be included in the proxy statement and proxy card relating to that meeting.

If your sharesa stockholder wishes to present a proposal at our 2022 annual meeting, but does not wish to have the proposal considered for inclusion in our proxy statement and proxy card, pursuant to the advance notice provision in our bylaws, such stockholder must give written notice to our Corporate Secretary at our principal executive offices at the address noted above. The Corporate Secretary must receive such notice no earlier than February 8, 2022, and no later than March 10, 2022, provided that if the date of the Company common stock are2022 annual meeting of stockholders is held by a bank, broker or other nominee, youbefore June 8, 2022, such notice must follow the instructions providedinstead be received by the bank, broker or other nominee if you wishCorporate Secretary no earlier than the 120th day prior to change your vote.the 2022 annual meeting of stockholders and not later than the close of business on the 90th day prior to the 2022 annual meeting of stockholders in order for such notice to be timely.

WhatHow are the quorum requirements for the proposals?votes counted?

In orderVotes will be counted by the inspector of election appointed for the 2021 Annual Meeting, who will separately count, with respect to take action on(i) the proposals,proposal to elect directors, votes “For,” “Withhold” and broker non-votes; and (ii) Proposals 2, 3 and 4, votes “For” and “Against,” abstentions and, if applicable, broker non-votes.

What are “broker non-votes”?

As discussed above, when a quorum, consisting of the holders of 105,046,344 shares (a majority of the aggregate numberbeneficial owner of shares ofheld in “street name” does not give instructions to his or her broker, bank or nominee holding the Company’s common stock issued and outstanding and entitledshares as to how to vote as ofon matters deemed to be “non-routine” under NYSE rules, the record date forbroker, bank or nominee cannot vote the Special Meeting), must be present in person or by proxy. This is referred to as a "quorum." Proxies marked "Abstain" and broker non-votes (as further discussed below) will be treated asshares. These unvoted shares that are present for purposes of determining the presence of a quorum.

What happens if a quorum is not present at the Special Meeting?

If the shares present in person or represented by proxy at the Special Meeting are not sufficient to constitute a quorum, the stockholders by a vote of the holders of a majority of votes present in person or represented by proxy (which may be voted by the proxyholders) may, without further notice to any stockholder (unless a new record date is set), adjourn the meeting to a different time and place to permit further solicitations of proxies sufficient to constitute a quorum.

What is an "abstention" and how would it affect the vote?

An "abstention" occurs when a stockholder sends in a proxy with explicit instructions to decline to vote regarding a particular matter. Abstentions are counted as present for purposes of determining a quorum. Abstentions with respect to the Reverse Stock Split proposal will have the same effect as a vote "Against" the proposals. Abstentions“broker non-votes.” Proposals 1, 3 and 4 are not considered to be votes cast“non-routine” under NYSE rules and we, therefore, will have no impact on the 2019 Equity Plan proposal and the adjournment proposal.expect broker non-votes to exist in connection with those proposals.

What isAs a “broker non-vote and how would it affect the vote?

Brokers, banks or other nominees that are member firms of the New York Stock Exchange and who hold shares in street name for customers have the discretion to vote those shares with respect to certain matters if they have not received instructions from the beneficial owners. If a broker that is a record holder of common stock does return a signed proxy, but is not authorized to vote on one or more matters (with respect to each such matter, a "broker non-vote"), the shares of common stock represented by such proxy will be considered present at the Special Meeting for purposes of determining the presence of a quorum. A broker that is a member of the New York Stock Exchange is prohibited, unless the stockholder provides the broker with written instructions, from giving a proxy on nonroutine matters. Consequently, your brokerage firm or other nominee will have discretionary authority to vote your shares with respect to routine matters but may not vote your shares with respect to non-routine matters.

We believe that each of the Reverse Stock Split proposal and the adjournment proposal are deemed to be a "routine" matter. Therefore,reminder, if you are a beneficial owner of shares registeredheld in “street name,” in order to ensure your shares are voted in the name of your broker or other nominee andway you fail to provide instructions to your broker or nominee as to how to vote your shares on the Reverse Stock Split proposal or the adjournment proposal, your broker or nominee will have the discretion to vote your shares however they see fit. Accordingly, ifwould prefer, you fail tomust provide voting instructions to your broker or nominee holding the shares by the deadline provided in the materials you receive from your broker or nominee can vote your shares on the Reverse Stock Split proposal or the adjournment proposal in a manner that is contrary to what you intend. In addition, while we do not expect any broker non-votes on the Reverse Stock Split proposal or the adjournment proposal, if you do not provide voting instructions and your broker or nominee fails to vote your shares, this will have the same effect as a vote "Against" the Reverse Stock Split proposal. If you are a beneficial owner of shares registered in the name of your broker or other nominee, we strongly encourage you to provide voting instructions to the broker or nominee that holds your shares to ensure that your shares are voted in the manner in which you want them to be voted.nominee.

Brokers will not have this discretionary authority with respectHow many votes are needed to the approval of the 2019 Equity Plan and because approval of the 2019 Equity Plan requires the affirmative vote of theapprove each proposal?

The holders of a majority of the shares of stock that are present in person or by proxy and entitled to vote at the Special Meeting, broker non-votes will have no effect.

Can other matters be decided at the Special Meeting?

Other than the Reverse Stock Split proposal, the 2019 Equity Plan proposal and the adjournment proposal, no other matters will be presented for action by the stockholders at the Special Meeting.

Who will conduct the proxy solicitation and how much will it cost?

We are soliciting proxies from stockholders on behalf of the Board and will pay for all costs incurred by it in connection with the solicitation. In addition to solicitation by mail, the directors, officers and associates of the Company and its subsidiaries may solicit proxies from stockholders of the Company in person or by telephone, facsimile or email without additional compensation other than reimbursement for their actual expenses.

We have retained The Proxy Advisory Group, LLC, a proxy solicitation firm, to assist in the solicitation of proxies and to provide related advice and informational support for a service fee, plus customary disbursements, which are not expected to exceed $25,000in the aggregate. Arrangements also will be made with brokerage firms and other custodians, nominees and fiduciaries for the forwarding of solicitation material to the beneficial owners of stock held of record by such persons, and we will reimburse such custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses in connection with the forwarding of solicitation materials to the beneficial owners of our stock.

If you have any questions or need assistance voting your shares of the Company common stock, please contact The Proxy Advisory Group, LLC, the Company's proxy solicitor, by calling (212) 616-2180.

THE REVERSE STOCK SPLIT PROPOSAL

The Company is asking stockholders to adopt and approve the proposal that the Company’s Amended and Restated Certificate of Incorporation be amended, by way of a Certificate of Amendment, to effect the Reverse Stock Split. The proposed amendment, if effected, will effect a Reverse Stock Split of the outstanding shares of the Company's common stock at a Reverse Stock Split ratio of not less than 1-for-20 and not greater than 1-for-60, with the exact ratio and effective time of the Reverse Stock Split to be determined by the Board at any time within one year of the date of the Special Meeting. The foregoing description of the proposed amendment is a summary and is subject to the full text of the proposed amendment, which is attached to this proxy statement as Annex A.

If approved by the stockholders, the Reverse Stock Split, if any, would become effective at a time, and at a ratio, to be designated by the Board of Directors. The Board of Directors may effect only one Reverse Stock Split as a result of this authorization. The Board of Directors also may determine in its discretion not to effect the Reverse Stock Split and not to file the Certificate of Amendment. No further action on the part of stockholders will be required to either implement or abandon the Reverse Stock Split. The determination of the ratio of the Reverse Stock Split will be based on a number of factors, described further below under the heading “—Criteria to be Used for Determining Whether to Implement Reverse Stock Split.” The Reverse Stock Split, if approved by stockholders and if deemed by the Board of Directors to be in the best interests of us and our stockholders, will be effected, if at all, at a time that is not later than the date that is within one year from the date of the Special Meeting.

As of the July 12, 2019 record date 210,092,687 shares of our common stock were issued and outstanding. Based on such number of shares of our common stock issued and outstanding, immediately following the effectiveness of the Reverse Stock Split (and without giving any effect to the payment of cash in lieu of fractional shares), we will have, depending on the Reverse Stock Split ratio selected by our Board of Directors, issued and outstanding shares of stock as illustrated in the table under the caption “—Effects of the Reverse Stock Split—Effect on Shares of Common Stock.”

The Reverse Stock Split will be realized simultaneously for all outstanding common stock, options to purchase shares of our common stock (including shares available for future grants under the 2017 Equity Incentive Plan and the 2019 Equity Plan if approved by our stockholders pursuant to Proposal 2) and warrants to purchase shares of our common stock. The Reverse Stock Split will affect all holders of common stock uniformly and each stockholder will hold the same percentage of common stock outstanding immediately following the Reverse Stock Split as that stockholder held immediately prior to the Reverse Stock Split, except for immaterial adjustments that may result from the treatment of fractional shares as described below. The Reverse Stock Split will not change the par value of our common stock and will not reduce the number of authorized shares of common stock (see "—Effects of the Reverse Stock Split").

No fractional shares of common stock will be issued as a result of the Reverse Stock Split. Instead, any stockholder who would have been entitled to receive a fractional share as a result of the Reverse Stock Split will receive cash payments in lieu of such fractional shares.

Reasons for the Reverse Stock Split

Nasdaq Compliance. Our common stock is publicly traded and listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol "SLS." Our Board of Directors authorized the reverse split of our common stock with the primary intent of increasing the per share trading price of our common stock in order to ensure that we continue to satisfy the requirements for the continued listing of our common stock on Nasdaq which we believe helps support and maintain stock liquidity and Company recognition for our stockholders. Accordingly, we believe that effecting the Reverse Stock Split is in the Company's and our stockholders' best interests.

Companies listed on the Nasdaq are subject to various rules and requirements imposed by Nasdaq which must be satisfied in order to continue having their stock listed on the exchange (these are called the Nasdaq’s continued listing standards). One of these standards is the “minimum bid price” requirement set forth in Marketplace Rule 5450(a)(1), which requires that the bid price of the stock of listed companies be at least $1.00 per share. A listed company risks being delisted and removed from the Nasdaq if the closing bid price of its stock remains below $1.00 per share for an extended period of time. The closing bid price of our common stock has been below $1.00 per share since April 16, 2019.

On May 31, 2019, we received a letter from Nasdaq indicating that, based upon the closing bid price of our common stock for the last 30 consecutive business days, we did not meet the minimum bid price of $1.00 per share required for continued listing on the Nasdaq Capital Market pursuant to Minimum Bid Price Rule. We have been provided an initial period of 180 calendar days, or until November 27, 2019, to regain compliance with the Minimum Bid Price Rule. The letter also indicated that if at any time before November 27, 2019 the closing bid price for our common stock is at least $1.00 for a minimum of ten consecutive business days, Nasdaq will provide written notification to the company that it complies with the Minimum Bid Price Rule. If we do not regain compliance with the Minimum Bid Price Rule by November 27, 2019, we may be eligible for an additional compliance period of 180 calendar days; however, such extension is at the discretion of Nasdaq and there can be no assurance that Nasdaq will grant the extension. If we do not regain compliance with the Minimum Bid Price Rule by November 27, 2019 and Nasdaq does not grant us an additional compliance period at that time, Nasdaq will provide written notification to us that our common stock may be delisted. At that time, we may appeal Nasdaq’s delisting determination to a Nasdaq hearings panel. If we timely appeal, our common stock would remain listed pending the panel’s decision. There can be no assurance that, if we do appeal the delisting determination by Nasdaq to the panel, such appeal would be successful.

Additional Potential Investors. In addition to bringing the per share trading price of our common stock back above $1.00, we also believe that the Reverse Stock Split will make our common stock more attractive to a broader range of institutional and other investors, as we have been advised that the current per share trading price of our common stock may affect its acceptability to certain institutional investors, professional investors and other members of the investing public. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. In addition, some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers.

Financial Planning Flexibility. The Board believes it is in the best interest of the Company to approve the Amendment to effect the Reverse Stock Split of the Company’s issued and outstanding common stock to give the Company greater flexibility in considering and planning for future potential business needs. The Reverse Stock Split will result in additional authorized and unissued shares becoming available for general corporate purposes as the Board may determine from time to time, including for use under its equity compensation plans.

Reducing the number of outstanding shares of our common stock through the Reverse Stock Split is intended, absent other factors, to increase the per share trading price of our common stock. However, other factors, such as our financial results, market conditions and the market perception of our business may adversely affect the per share trading price of our common stock. As a result, there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above, that the per share trading price of our common stock will increase following the Reverse Stock Split or that the per share trading price of our common stock will not decrease in the future.

Criteria to be Used for Determining Whether to Implement Reverse Stock Split

In determining whether to implement the Reverse Stock Split and which Reverse Stock Split ratio to implement, if any, following receipt of stockholder approval of the amendment to our Amended and Restated Certificate of Incorporation to effect the Reverse Stock Split, the Board of Directors may consider, among other things, various factors, such as:

Certain Risks and Potential Disadvantages Associated with the Reverse Stock Split

We cannot assure you that the proposed Reverse Stock Split will increase our stock price. We expect that the Reverse Stock Split will increase the per share trading price of our common stock. However, the effect of the Reverse Stock Split on the per share trading price of our common stock cannot be predicted with any certainty, and the history of reverse stock splits for other companies is varied, particularly since some investors may view a reverse stock split negatively. It is possible that the per share trading price of our common stock after the Reverse Stock Split will not increase in the same proportion as the reduction in the number of our outstanding shares of common stock following the Reverse Stock Split, and the Reverse Stock Split may not result in a per share trading price that would attract investors who do not trade in lower priced stocks. In addition, although we believe the Reverse Stock Split may enhance the marketability of our common stock to certain potential investors, we cannot assure you that, if implemented, our common stock will be more attractive to investors. Even if we implement the Reverse Stock Split, the per share trading price of our common stock may decrease due to factors unrelated to the Reverse Stock Split, including our future performance. If the Reverse Stock Split is consummated and the per share trading price of the common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the Reverse Stock Split.

The proposed Reverse Stock Split may decrease the liquidity of our common stock and result in higher transaction costs. The liquidity of our common stock may be negatively impacted by the Reverse Stock Split, given the reduced number of shares that would be outstanding after the Reverse Stock Split, particularly if the per share trading price does not increase as a result of the Reverse Stock Split. In addition, if the Reverse Stock Split is implemented, it will increase the number of our stockholders who own "odd lots" of fewer than 100 shares of common stock. Brokerage commission and other costs of transactions in odd lots are generally higher than the costs of transactions of more than 100 shares of common stock. Accordingly, the Reverse Stock Split may not achieve the desired results of increasing marketability of our common stock as described above.

Dilution to existing stockholders if the Company issues new shares of Common Stock. Although the Reverse Stock Split will not in itself cause dilution to our existing stockholders, the number of shares the Company will be authorized to issue will not be decreased proportionally. Thus, should the Company decide to issue new shares of common stock in the future to raise capital, existing stockholders’ ownership will be diluted.

Procedure for Effecting Reverse Stock Split and Exchange of Stock Certificates

If the Certificate of Amendment is approved by our stockholders, and if at such time the Board of Directors still believes that the Reverse Stock Split is in the best interests of the Company and its stockholders, the Board of Directors will determine the ratio of the Reverse Stock Split to be implemented. We will file the Certificate of Amendment with the Secretary of State of the State of Delaware at such time as the Board of Directors has determined the appropriate effective time for the Reverse Stock Split (the “Effective Time”). The Board of Directors may delay effecting the Reverse Stock Split, if at all, until a time that is not later than one year from the date of the Special Meeting, without re-soliciting stockholder approval. The Reverse Stock Split will become effective on the date of filing of the Certificate of Amendment with the Secretary of State of the State of Delaware. Beginning on the effective date of the Reverse Stock Split, each certificate representing pre-Reverse Stock Split shares will be deemed for all corporate purposes to evidence ownership of post-Reverse Stock Split shares.

If, at any time prior to the filing of the Certificate of Amendment with the Delaware Secretary of State, notwithstanding stockholder approval, and without further action by the stockholders, the Board of Directors, in its sole discretion, determines that it is in the Company's best interests and the best interests of the Company's stockholders to delay the filing of the Certificate of Amendment or abandon the Reverse Stock Split, the Reverse Stock Split may be delayed or abandoned.

Stockholders will not receive fractional shares of common stock in connection with the Reverse Stock Split. Instead, the transfer agent will aggregate all fractional shares and sell them as soon as practicable after the Effective Time at the then-prevailing prices on the open market, on behalf of those stockholders who would otherwise be entitled to receive a fractional share as a result of the Reverse Stock Split. We expect that the transfer agent will conduct the sale in an orderly fashion at a reasonable pace and that it may take several days to sell all of the aggregated fractional shares of our common stock. After the transfer agent's completion of such sale, stockholders who would have been entitled to a fractional share will instead receive a cash payment from the transfer agent in an amount equal to their respective pro rata shares of the total proceeds of that sale net of any brokerage costs incurred by the transfer agent to sell such stock.

Stockholders will not be entitled to receive interest for the period of time between the Effective Time and the date payment is made for their fractional share interest. You should also be aware that, under the escheat laws of certain jurisdictions, sums due for fractional interests that are not timely claimed after the funds are made available may be required to be paid to the designated agent for each such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds may have to obtain the funds directly from the state to which they were paid.

If you believe that you may not hold sufficient shares of the Company's common stock at the Effective Time to receive at least one share in the Reverse Stock Split and you want to continue to hold the Company's common stock after the Reverse Stock Split, you may do so by either:

in each case, so that you hold a number of shares of our common stock in your account prior to the Reverse Stock Split that would entitle you to receive at least one share of common stock in the Reverse Stock Split. Shares of our common stock held in registered form and shares of our common stock held in "street name" (that is, through a broker, bank or other holder of record) for the same stockholder will be considered held in separate accounts and will not be aggregated when effecting the Reverse Stock Split.

Effects of the Reverse Stock Split

After the effective date of the Reverse Stock Split, if implemented by the Board of Directors, each stockholder will own a reduced number of shares of common stock. The principal effect of the Reverse Stock Split will be to proportionately decrease the number of outstanding shares of our common stock based on the Reverse Stock Split ratio selected by our Board of Directors. As a matter of Delaware law, the implementation of the Reverse Stock Split does not require a reduction in the total number of authorized shares of our common stock.

Voting rights and other rights of the holders of our common stock will not be affected by the Reverse Stock Split, other than as a result of the treatment of fractional shares as described above. For example, a holder of 2% of the voting power of the outstanding shares of our common stock immediately prior to the effectiveness of the Reverse Stock Split will generally continue to hold 2% (assuming there is no impact as a result of the payment of cash in lieu of issuing fractional shares) of the voting power of the outstanding shares of our common stock after the Reverse Stock Split. The number of stockholders of record will not be affected by the Reverse Stock Split (except to the extent any are cashed out as a result of holding fractional shares). If approved and implemented, the Reverse Stock Split may result in some stockholders owning "odd lots" of less than 100 shares of our common stock. Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally somewhat higher than the costs of transactions in "round lots" of even multiples of 100 shares. Our Board of Directors believes, however, that these potential effects are outweighed by the benefits of the Reverse Stock Split.

Effect on Shares of Common Stock

The following table contains approximate information, based on share information as of July 17, 2019, relating to our outstanding common stock assuming Reverse Stock Split ratios of 1-for-20, 1-for-40 and 1-for-60, which reflect the low end, middle and high end of the range that our stockholders are being asked to approve. In addition, the following table sets forth (i) the number of shares of our common stock that would be issued and outstanding, (ii) the number of shares of our common stock that would be reserved for issuance pursuant to outstanding warrants and options and (iii) the weighted-average exercise price of outstanding options and warrants, each giving effect to the Reverse Stock Split and based on securities outstanding as of July 17, 2019.

| Number of Shares Before Reverse Stock Split | Reverse Stock Split Ratio of 1-for-20 | Reverse Stock Split Ratio of 1-for-40 | Reverse Stock Split Ratio of 1-for-60 | |||||||||||||

| Number of Shares of Common Stock Issued and Outstanding | 225,992,587 | 11,299,629 | 5,649,815 | 3,766,543 | ||||||||||||

| Number of Shares of Common Stock Reserved for Issuance | 105,151,046 | 337,757,553 | 343,878,776 | 345,919,184 | ||||||||||||

| Weighted Average Exercise Price of Options | $ | 2.32 | $ | 46.40 | $ | 92.67 | $ | 139.20 | ||||||||

| Weighted Average Exercise Price of Warrants | $ | 4.03 | $ | 80.60 | $ | 161.20 | $ | 241.80 | ||||||||

If this Reverse Stock Split Proposal is approved and our Board of Directors elects to effect the Reverse Stock Split, the number of outstanding shares of common stock will be reduced in proportion to the ratio of the split chosen by our Board of Directors and we would communicate to the public, prior to the effective date of the stock split, additional details regarding the Reverse Stock Split, including the specific ratio selected by our Board of Directors.

After the effective date of the Reverse Stock Split that our Board of Directors elects to implement, our common stock would have a new committee on uniform securities identification procedures, or CUSIP number, a number used to identify our common stock.

Our common stock is currently registered under Section 12(b) of the Securities Exchange Act of 1934, or the Exchange Act, and we are subject to the periodic reporting and other requirements of the Exchange Act. The Reverse Stock Split will not affect the registration of our common stock under the Exchange Act or the listing of our common stock on Nasdaq. Following the Reverse Stock Split, our common stock will continue to be listed on Nasdaq under the symbol "SLS," although it will be considered a new listing with a new CUSIP number.

Pursuant to our Amended and Restated Certificate of Incorporation, our authorized capital stock includes 5,000,000 shares of Preferred Stock, par value $0.0001 per share. The proposed amendment to our Amended and Restated Certificate of Incorporation to effect the Reverse Stock Split would not impact the total authorized number of shares of preferred stock or the par value of the preferred stock.

The proposed amendments to our Amended and Restated Certificate of Incorporation will not affect the par value of our common stock, which will remain at $0.0001.

As a result of the Reverse Stock Split, upon the Effective Time, the stated capital on our balance sheet attributable to our common stock, which consists of the par value per share of our common stock multiplied by the aggregate number of shares of our common stock issued and outstanding, will be reduced in proportion to the size of the Reverse Stock Split, subject to a minor adjustment in respect of the treatment of fractional shares, and the additional paid-in capital account will be credited with the amount by which the stated capital is reduced. Our stockholders' equity, in the aggregate, will remain unchanged.

Effect on Authorized Shares of Common Stock

Currently, we are authorized to issue up to a total of 350,000,000 shares of common stock. On the Record Date, there were 210,082,687 shares of our common stock issued and outstanding, warrants to purchase 32,781,849 shares of our common stock issued and outstanding (with a weighted average exercise price of $2.07) and options to purchase 1,210,234 shares of our common stock issued and outstanding under our equity compensation plans (with a weighted average exercise price of $2.32). This leaves only 105,151,046 shares of our authorized common stock available for future issuance, both for equity financings and equity compensation.

Effecting the Reverse Stock Split will not change the total authorized number of shares of common stock. However, the reduction in the issued and outstanding shares, and the corresponding adjustment of shares issuable pursuant to warrants and options, which would be decreased by a factor of between 20 and 60, would provide more authorized shares available for future issuance. Because holders of our common stock have no preemptive rights to purchase or subscribe for any unissued stock of the Company, the issuance of additional shares in the future of authorized common stock that will become newly available as a result of the implementation of the Reverse Stock Split will reduce the current stockholders’ percentage ownership interest in the total outstanding shares of common stock.

We may issue additional equity capital in the future to support our planned clinical research and general operations. The additional available shares that the proposed Reverse Stock Split will provide will allow us to pursue any such financing. However, with the exception of the reservation of shares for issuance upon exercise of the our outstanding warrants and the reservation of shares underlying the 2017 Incentive Plan and 2019 Equity Plan, if it is approved by our stockholders at the Special Meeting, we currently do not have any specific plans, arrangements or understandings to issue any of the shares of common stock that will be newly available as a result of the implementation of the Reverse Stock Split.

Notwithstanding the decrease in the number of outstanding shares following the proposed Reverse Stock Split, our Board of Directors does not intend for this transaction to be the first step in a "going private transaction" within the meaning of Rule 13e-3 of the Exchange Act.

Shares Held in Book-Entry and Through a Broker, Bank or Other Holder of Record

If you hold registered shares of our common stock in a book-entry form, you do not need to take any action to receive your post-Reverse Stock Split shares of our common stock in registered book-entry form or your cash payment in lieu of fractional shares, if applicable. If you are entitled to post-Reverse Stock Split shares of our common stock, a transaction statement will automatically be sent to your address of record as soon as practicable after the Effective Time indicating the number of shares of our common stock you hold. In addition, if you are entitled to a payment of cash in lieu of fractional shares, a check will be mailed to you at your registered address as soon as practicable after the Effective Time. By signing and cashing this check, you will warrant that you owned the shares of the Company's common stock for which you received a cash payment.

At the Effective Time, we intend to treat stockholders holding shares of our common stock in "street name" (that is, through a broker, bank or other holder of record) in the same manner as registered stockholders. Brokers, banks or other holders of record will be instructed to effect the Reverse Stock Split for their beneficial holders holding shares of our common stock in "street name"; however, these brokers, banks or other holders of record may apply their own specific procedures for processing the Reverse Stock Split. If you hold your shares of our common stock with a broker, bank or other holder of record, and you have any questions in this regard, we encourage you to contact your holder of record.

Shares Held in Certificated Form

If you hold any of your shares of our common stock in certificated form (the "Old Certificate(s)"), you will receive a transmittal letter from our transfer agent as soon as practicable after the Effective Time. The transmittal letter will be accompanied by instructions specifying how you can deliver your Old Certificate(s) so that you are in a position to freely trade your post-Reverse Stock Split shares of our common stock, which will be in a book-entry form, evidenced by a transaction statement that will be sent to your address of record as soon as practicable after your delivery of a letter of transmittal and your Old Certificate, together with any payment of cash in lieu of fractional shares to which you are entitled. Until surrendered as contemplated herein, a stockholder's Old Certificate(s) shall be deemed at and after the Effective Time to represent the number of full shares of our common stock resulting from the Reverse Stock Split.

YOU SHOULD NOT SEND YOUR OLD CERTIFICATES NOW. YOU SHOULD SEND THEM ONLY AFTER YOU RECEIVE THE LETTER OF TRANSMITTAL FROM OUR TRANSFER AGENT.

Under Delaware law, the affirmative vote of a majority of the shares of common stock issued and outstanding and entitled to vote at the Special2021 Annual Meeting is required to adopt and approvewill constitute a quorum for the amendment to our Amended and Restated Certificatetransaction of Incorporation to effect the Reverse Stock Split. Because adoption and approval of the amendment to our Amended and Restated Certificate of Incorporation to effect the Reverse Stock Split requires a majority of the outstanding shares, an abstention with respect to the Reverse Stock Split proposal will have the same effect as a vote "Against" the proposal.

The Company’s Board of Directors recommends that you vote "FOR" the Reverse Stock Split proposal.

Under the Delaware General Corporation Law, our stockholders are not entitled to dissenter's rights or appraisal rights with respect to the Reverse Stock Split described in this proposal and we will not independently provide our stockholders with any such rights.

Interest of Certain Persons in Matters to be Acted Upon

No officer or director has any substantial interest, direct or indirect, by security holdings or otherwise, in the Reverse Stock Split that is not shared by all of our other stockholders.

Certain U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following discussion is a general summary of certain U.S. federal income tax consequences of the Reverse Stock Split that may be relevant to holders of our common stock that hold such stock as a capital asset for U.S. federal income tax purposes (generally, property held for investment). This summary is based upon the provisions of the Internal Revenue Code of 1986, as amended (the "Code"), Treasury regulations promulgated thereunder, administrative rulings and judicial decisions as of the date hereof, all of which may change, possibly with retroactive effect, resulting in U.S. federal income tax consequences that may differ from those discussed below.

This discussion applies only to holders that are U.S. Holders (as defined below) and does not address all aspects of federal income taxation that may be relevant to such holders in light of their particular circumstances or to holders that may be subject to special tax rules, including: (i) holders subject to the alternative minimum tax; (ii) banks, insurance companies, or other financial institutions; (iii) tax-exempt organizations; (iv) dealers in securities or commodities; (v) regulated investment companies or real estate investment trusts; (vi) partnerships (or other flow-through entities for U.S. federal income tax purposes and their partners or members); (vii) traders in securities that elect to use a mark-to-market method of accounting for their securities holdings; (viii) U.S. Holders (as defined below) whose "functional currency" is not the U.S. dollar; (ix) persons holding our common stock as a position in a hedging transaction, "straddle," "conversion transaction" or other risk reduction transaction; (x) persons who acquire shares of our common stock in connection with employment or other performance of services; or (xi) U.S. expatriates. If a partnership (including any entity or arrangement treated as a partnership for U.S. federal income tax purposes) holds shares of our common stock, the tax treatment of a holder that is a partner in the partnership generally will depend upon the status of the partner and the activities of the partnership.

We have not sought, and will not seek, an opinion of counsel or a ruling from the Internal Revenue Service ("IRS") regarding the U.S. federal income tax consequences of the Reverse Stock Split and there can be no assurance that the IRS will not challenge the statements and conclusions set forth below or a court would not sustain any such challenge. The following summary does not address any U.S. state or local or any foreign tax consequences, any estate, gift or other non-U.S. federal income tax consequences, or the Medicare tax on net investment income.

EACH HOLDER OF COMMON STOCK SHOULD CONSULT SUCH HOLDER'S TAX ADVISOR WITH RESPECT TO THE PARTICULAR TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT TO SUCH HOLDER.

For purposes of the discussion below, a "U.S. Holder" is a beneficial owner of shares of our common stock that for U.S. federal income tax purposes is: (1) an individual citizen or resident of the United States; (2) a corporation (including any entity taxable as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state or political subdivision thereof; (3) an estate the income of which is subject to U.S. federal income taxation regardless of its source; or (4) a trust, if (i) a court within the United States is able to exercise primary supervision over the administration of the trust and one or more U.S. persons have the authority to control all substantial decisions of the trust, or (ii) the trust has a valid election in effect to be treated as a U.S. person.

The Reverse Stock Split is intended to be treated as a "recapitalization" for U.S. federal income tax purposes. As a result, a U.S. Holder generally should not recognize gain or loss upon the Reverse Stock Split, except with respect to cash received in lieu of a fractional share of our common stock, as discussed below. A U.S. Holder's aggregate tax basis in the shares of our common stock received pursuant to the Reverse Stock Split should equal the aggregate tax basis of the shares of our common stock surrendered (excluding any portion of such basis that is allocated to any fractional share of our common stock), and such U.S. Holder's holding period in the shares of our common stock received should include the holding period in the shares of our common stock surrendered. Treasury regulations promulgated under the Code provide detailed rules for allocating the tax basis and holding period of the shares of our common stock surrendered to the shares of our common stock received pursuant to the Reverse Stock Split. Holders of shares of our common stock acquired on different dates and at different prices should consult their tax advisors regarding the allocation of the tax basis and holding period of such shares.

A U.S. Holder that receives cash in lieu of a fractional share of our common stock pursuant to the Reverse Stock Split should recognize capital gain or loss in an amount equal to the difference between the amount of cash received and the U.S. Holder's tax basis in the shares of our common stock surrendered that is allocated to such fractional share. Such capital gain or loss should be long term capital gain or loss if the U.S. Holder's holding period for our common stock surrendered exceeded one yearbusiness at the Effective Time.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMEND A VOTE "FOR" PROPOSAL NO. 1 RELATING TO THE AMENDMENT OF OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT.

PROPOSAL 2: APPROVAL OF THE COMPANY’S 2019 EQUITY INCENTIVE PLAN

We are requesting that you vote to approve the adoption of the SELLAS Life Sciences Group, Inc. 2019 Equity Incentive Plan (the “2019 Equity Plan”), which was approved by our Board of Directors on July 26, 2019 effective upon stockholder approval at the Special2021 Annual Meeting. If this proposal is approved:

The 2019 Equity Plan includes the following provisions:

Why We Are Requesting Stockholder Approval of the 2019 Equity Plan

We believe that our future success depends, in large part, upon our ability to maintain a competitive position in attracting, retaining and motivating persons who are expected to make important contributions to the Company by providing such persons with equity ownership opportunities and performance-based incentives. The life sciences industry is highly competitive, and our results are largely attributable to the talents, expertise, efforts and dedication of our employees. Our compensation program, including the granting of equity compensation, is the primary means by which we attract and recruit new employees, as well as retain our most experienced and skilled employees.